Gifts in a will or by beneficiary designation are two easy ways to make gifts that will have an impact on the role of science in public opinion and policy making for years to come — and they don’t cost anything now.

If you have already included a gift in your estate plans to benefit the future of the Union of Concerned Scientists, be sure to let us know so that we may best honor your wishes.

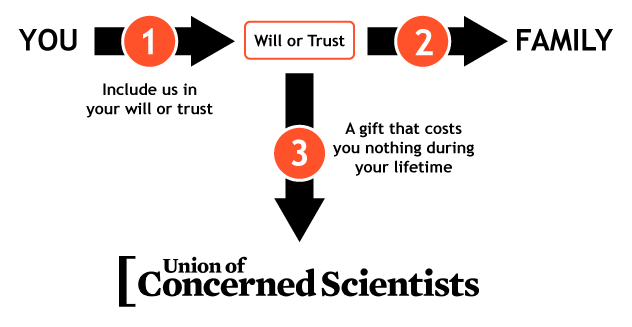

Gifts in a will or trust

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for the Union of Concerned Scientists. Once you have provided for your loved ones, we hope you will consider making fighting for science-based decision making part of your life story through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

LASTING IMPACT

Your gift will create your legacy of action for our planet.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

NO COST

Costs you nothing now to give in this way.

Four simple, “no-cost-now” ways to give in your will:

General gift in your will

Leaves a gift of a stated sum of money in your will or living trust. For example, you might decide to leave each of your grandchildren $10,000. It’s considered to be ‘general’ because it doesn’t specify from where the money comes.

Residual gift in your will

Leaves what is left over after all other debts, taxes, and other expenses have been paid.

Specific gift in your will

Leaves a specific dollar amount, percentage, fraction, or specific items (collections, art, books, jewelry, and so on).

Contingent gift in your will

Leaves a stated amount or share only if a spouse, family member or other heir/beneficiary does not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to the Union of Concerned Scientists or your local council contingent upon the survival of your spouse.

If you have included UCS as a beneficiary of your will or trust, we hope you will let us know so that we can thank you and welcome you to the Kurt Gottfried Society. You can contact us at (617) 301-8095 or plannedgiving@ucsusa.org or use our gift notification form.

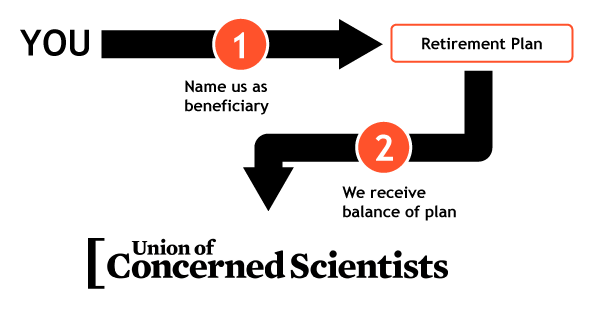

Gifts by beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in creating a world informed and inspired by the Union of Concerned Scientists — and it costs you nothing now.

By naming UCS as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of defending the world with science, before it’s too late.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes on retirement assets

Reduce or avoid

probate fees

No cost to you now

to give

Create your legacy with the Union of Concerned Scientists

To name the Union of Concerned Scientists as a beneficiary of your retirement plan or other financial plan, contact your bank or insurance company to see whether a change of beneficiary form must be completed.

How to update a beneficiary designation:

- Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

- Follow the links to change your beneficiary or fill out the form.

- Be sure to spell the name of our organization properly:

Union of Concerned Scientists - Include our tax identification number:

#04-2535767 - Save or submit your information online or return your Change of Beneficiary Form.

- Inform us of your gift by contacting us at (617) 301-8095 or plannedgiving@ucsusa.org or use our legacy gift commitment form.

Types of gifts

Retirement funds (beneficiary of your retirement plan)

You can simply name Union of Concerned Scientists as a beneficiary of your retirement plan to fight for the future of the world.

A gift of funds remaining in your bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing what you want – putting science into action to build a healthier planet and a safer world. The next time you visit your bank, you can name the Union of Concerned Scientists (Tax ID: 04-2535767) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward fighting for the place of science in decision-making for generations to come.

Donor Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name the Union of Concerned Scientists as a “successor” of your account or a portion of your account value, you become a champion for science and a defender of truth.

Savings bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since the Union of Concerned Scientists is a tax-exempt institution, naming us as a beneficiary means that 100% of your gift will go toward addressing some of today’s most pressing problems.

Complimentary Planning Resources are Just a Click Away!

Learn more about easy ways to leave a legacy with our free guides.