You can fight for evidence-based decision making while earning an income from your gift.

Charitable gift annuities

Charitable gift annuities (CGAs) offer a secure, fixed payment stream for yourself and/or a loved one for your lifetime(s). You will also receive tax benefits and the satisfaction of creating a lasting legacy through the Union of Concerned Scientists.

Benefits to you include the following:

A portion of the payout will be tax-free.

You receive an immediate charitable deduction for a portion of your gift.

Your gift passes to UCS outside of the probate process.

“The CGA provides a reliable and stable source of income with excellent tax benefits and it meets my goal of making positive use of my resources while also meeting my financial needs.”

Melissa Melum

UCS supporter

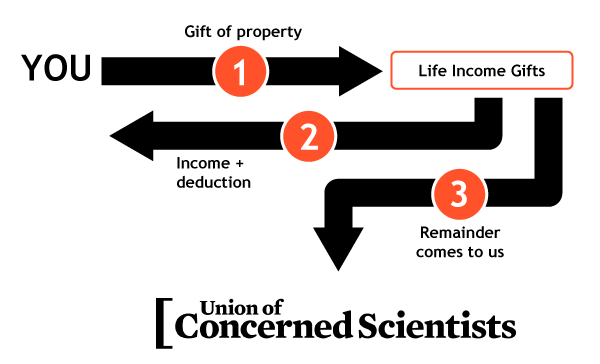

Charitable remainder trusts

Income for life for you and your family while reducing your taxes and supporting the Union of Concerned Scientists.

By using assets or cash to fund the trust, you receive income and an income tax credit in the year in which you transfer your assets. The remaining portion of the trust, after all payments have been made, passes to the Union of Concerned Scientists.

How it works:

- You transfer cash or an appreciated asset* into an irrevocable trust.

- The trustee then sells the asset, paying no capital gains tax, and reinvests the proceeds.

- For the rest of your life (or a term of years), you and/or another beneficiary receive payments from the trust.

- After your lifetime, the remaining principal is used to support the mission of the Union of Concerned Scientists.

Benefits to you include the following:

You receive income for life for you or your heirs.

You create your legacy of safeguarding the health and safety of the planet and its people.

Complimentary Planning Resources are Just a Click Away!

Learn more about easy ways to leave a legacy with our free guides.